Strategic Marketing Programs

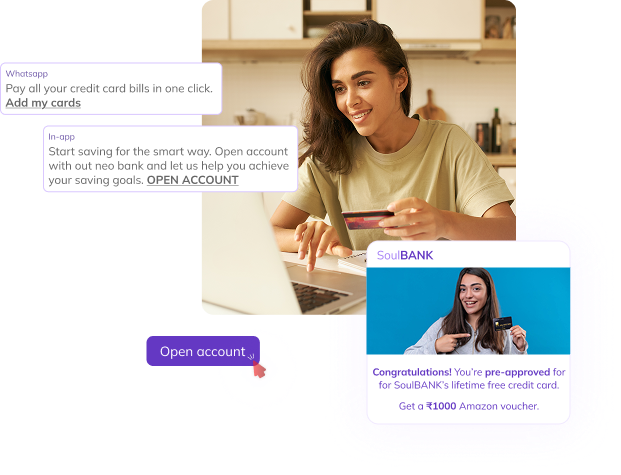

We implement strategies to drive customer acquisition and retention for banks

Map and optimise banker's journey

Ensuring seamless transitions and enhanced engagement across all consumer stages.

Use data segmentation & personalisation

To deliver tailored financial services optimised for customer behaviour, preferences, and life stage.

Monitor Real-Time Banking KPIs

Like activation rate, adoption rate, transaction frequency to optimise strategies.

Funnel optimisation to increase conversions

By enhancing touch points like support chat, loan applications with personalised offers.

MarTech audits and optimisation

We optimise technology to facilitate better customer engagement

MarTech audit to identify inefficiencies

and maximize campaign ROI while ensuring seamless marketing operations

Simplify customer journeys with right tools

to simplify KYC, personalised financial offers, and account management processes

Seamless upgrade to advanced MarTech

enable scalable campaigns, analyse spending, and target financial products precisely

Well-integrated dashboard

that consolidates financial data, customer insights, and rewards program metrics

End-to-end campaign management

We manage campaigns to boost reservations and guest loyalty

Execute and optimise campaigns

by leveraging real-time data to promote loans and credit cards, driving applications and usage

Boost offer relevance and conversions

with advanced testing like multi-variate and content performance analysis

Maximise ROI with behaviour-based campaigns

through dynamic up-selling and cross-selling

Proven Success Stories

See how a major BFSI brand turned retention into a trust engine

- 60% of digital accounts were going inactive within 90 days

- Activation retention rose by 38% within one quarter

- Referral-led acquisitions grew by 14%

- Retention improved using engagement scoring + micro-triggers + relationship touchpoints

- Read more: click here

See how a BFSI client boosted savings-plan adoption using micro-moments

- Nudges triggered for users checking balance 3×/week

- Re-engagement triggered when dashboard login dropped for 10 days

- Product adoption lifted by 29%

- Drop-offs reduced by 18%

- Read more: click here